See the EIC Earned Income Credit table amounts and how you can claim this valuable tax credit. The earned income tax credit is available to.

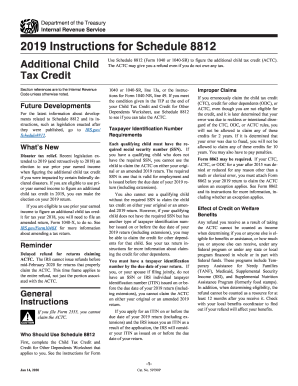

Schedule 8812 Instructions Fill Out And Sign Printable Pdf Template Signnow

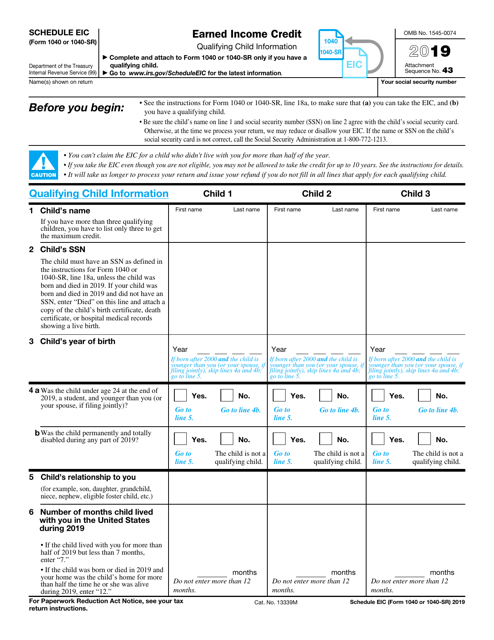

File Schedule EIC Form 1040 if you have a qualifying child.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

. The due date for filing your 2019 Form IL-1040 and paying any tax you owe is April 15 2020. You cannot change the amount withheld for 2019 as that time has passed. 2019 Earned Income Credit - 50 wide brackets 61219 At But less Your credit is-- At But less Your credit is-- At But less Your credit is--RASR 8222019.

Completed Worksheet B relating to the EIC in your Instructions for Forms 1040 and 1040-SR your earned income from Worksheet B line 4b plus 1 all of your nontaxable combat pay if you did not elect to include it in earned income for the EIC and 2 the Medicaid waiver payments you subtracted in line 5 of Step 5 of the EIC instructions if. Worksheet is -- Child Children Children Children worksheet is -- Child Children Children Children worksheet is -- Child Children Children. People without kids can qualify.

If worksheet Wks EIC was not produced because the taxpayer did not claim EIC in 2019 but Advanced Child Tax Credit ACTC was claimed the PYEI can be found on line 6a of Form 8812. Earned Income Tax Credit EIC Child tax credits. Wages salaries tips etc from W-2s.

For example lines 20 through 30 do not appear on Form 540 so the line number that follows line 19 on Form 540 is line 31. Here is more information about the W-4 Worksheet including how to fill out the W-4 allowance worksheet line by line. See the instructions for line 27a.

Self-Employed defined as a return with a Schedule CC-EZ tax form. If the If the If the. The lines on Form 540 are numbered with gaps in the line number sequence.

Online is defined as an individual income tax. Download a question and answer worksheet featuring examples where chemistry is needed to solve a medical problem as MS Word or pdf. IRS Publication 596 details the eligibility rules as well as earned income and AGI limits.

To try to avoid the balance due in the future you can consider increasing your contributions to pretax benefit accounts such as 401k plans or health. If neither the EIC nor the ACTC was claimed on the 2019 return see Internal Revenue Code Section 32c to calculate the 2019 earned income. For the 2021 tax year the earned income credit ranges from 1502 to 6728 depending on tax-filing status income and number of children.

Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Income Tax Rate The Illinois income tax rate is 495 percent 0495. You may qualify for the federal earned income credit.

Download a printable version of this article as a pdf to hand out in your class. TaxAct Deluxe 2021 Online Edition offers best-in-class security and step-by-step guidance to file your taxes online. Although it is late in the year if you were disappointed in the size of your refund or you had an unexpected balance due when you filed your 2018 tax return it is not too late to make changes for 2019.

See Federal Earned Income Tax Credit EIC for more information. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. The personal exemption amount for tax year 2019 is 2275.

For 2021 earned income and adjusted gross income AGI must each be less than. 51464 57414 married filing jointly with three or more qualifying children. You can elect to use your 2019 earned income to figure your 2021 earned income credit if your 2019 earned income is more than your 2021 earned income.

No cash value and void if transferred or where prohibited. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Online competitor data is extrapolated from press releases and SEC filings.

Expand to enter detailsEnter Form 1040 expected amounts. The earned income credit EIC is a refundable tax credit available to taxpayers who have earned income. Exemption Allowance The standard exemption amount has been extended and the cost-of-living adjustment has been restored.

Student Loan Interest deduction. File taxes online with 100 accuracy. You will have to pay the balance due or see if you are eligible for 2019 contributions to deductible IRAs or HSAs.

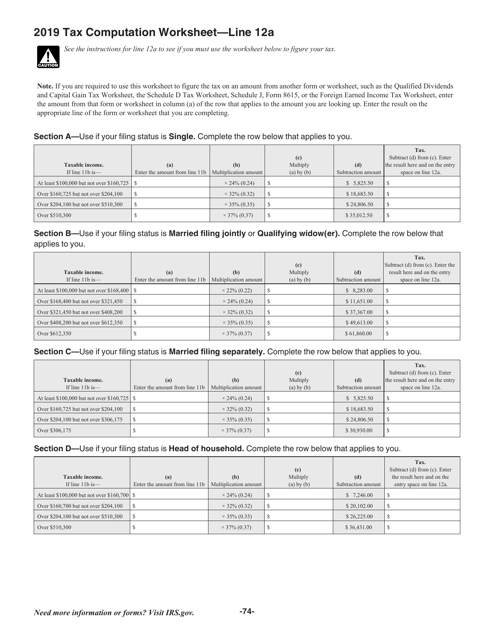

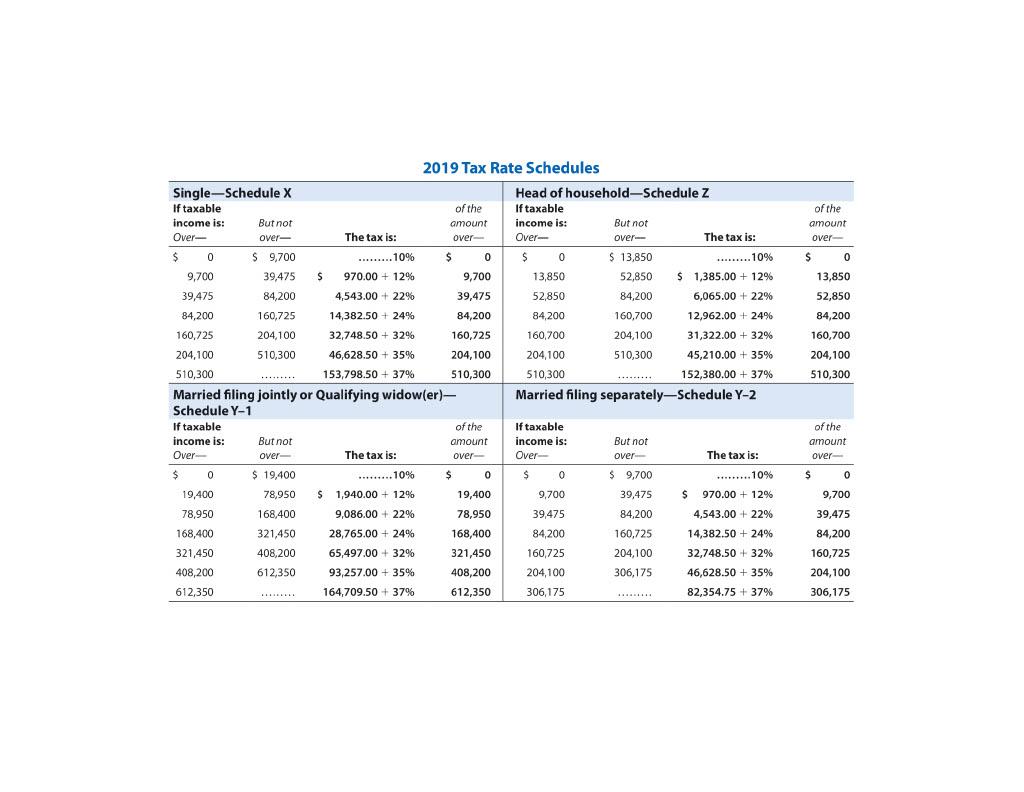

Tax Table Tax Computation Worksheet and EIC Table 2021 Inst 1040 Tax Tables Tax Table Tax Computation Worksheet and EIC Table 2020 Inst 1040 Tax Tables Tax Table and Tax Rate Schedules 2019 Inst 1040 Tax Tables Tax Table and.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Basics Beyond Tax Flash January 2020 Basics Beyond

Irs Form 1040 1040 Sr Schedule Eic Download Fillable Pdf Or Fill Online Earned Income Credit 2019 Templateroller

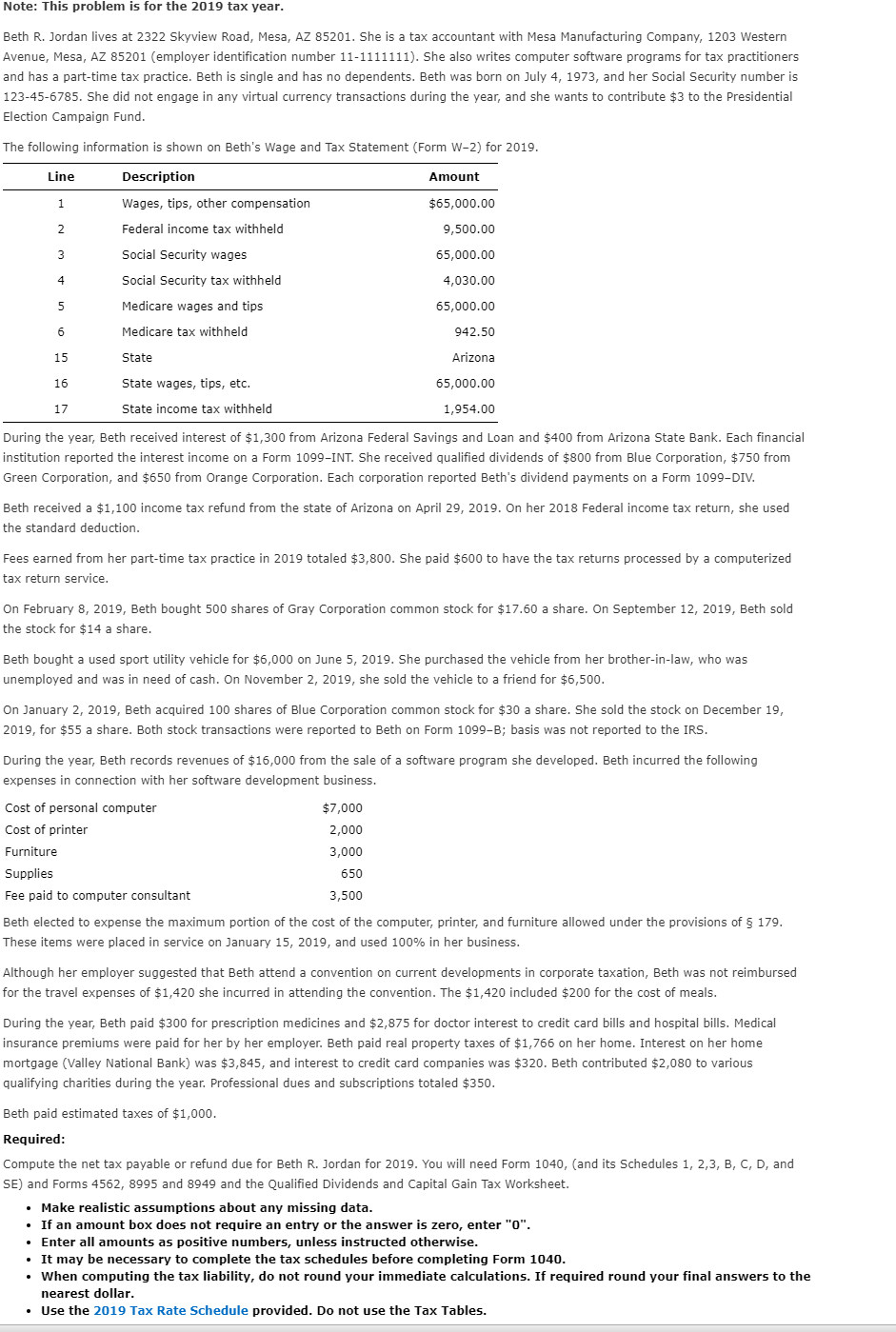

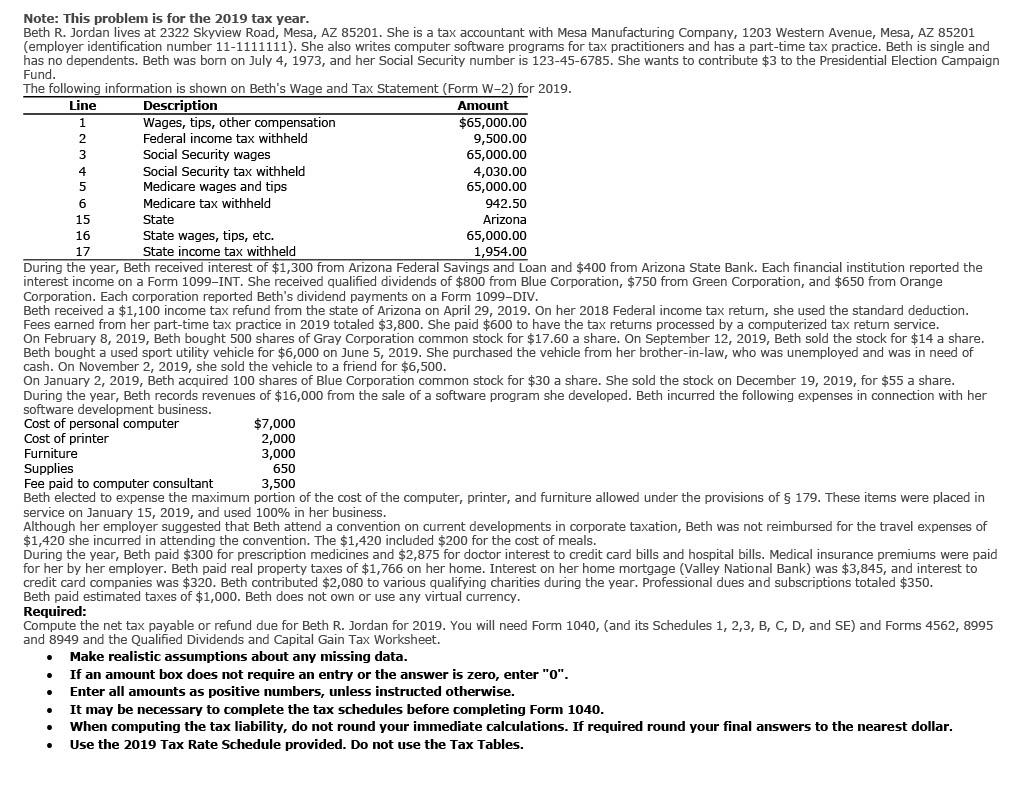

Note This Problem Is For The 2019 Tax Year Beth R Chegg Com

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Irs Form 1040 Download Printable Pdf Or Fill Online Line 12a Tax Computation Worksheet 2019 Templateroller

Solved Please Help Me With This 2019 Tax Return All Chegg Com

2019 Basics Beyond Tax Blast December 2019 Basics Beyond

Basics Beyond Tax Flash November 2019 Basics Beyond

Solved Please Help Me With This 2019 Tax Return All Chegg Com

2019 Basics Beyond Tax Blast September 2019 Basics Beyond

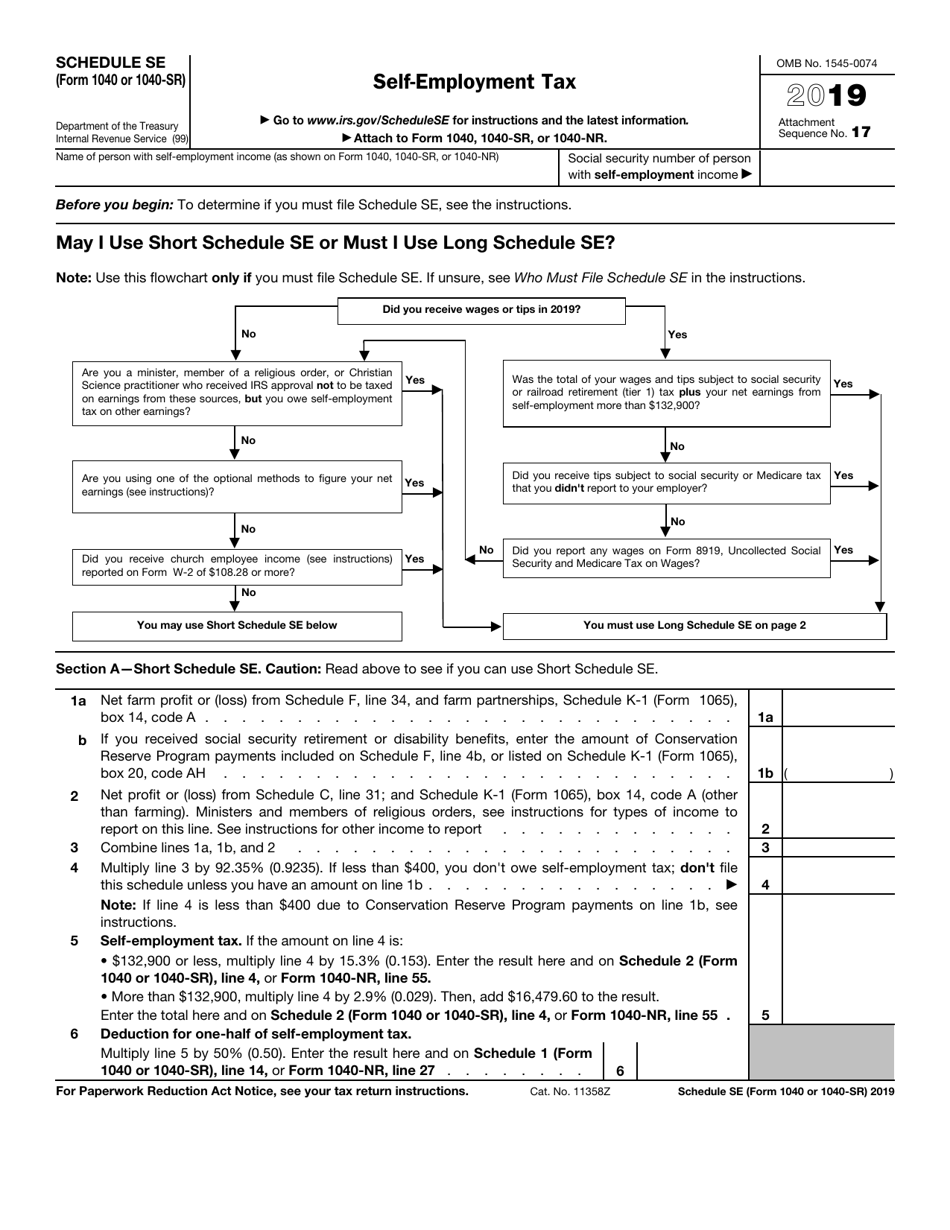

Irs Form 1040 1040 Sr Schedule Se Download Fillable Pdf Or Fill Online Self Employment Tax 2019 Templateroller

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

2021 W4 Form How To Fill Out A W4 What You Need To Know Form Need To Know Data Entry Job Description

Publication 596 2019 Earned Income Credit Eic Intended For Form W 9 2021 Tax Forms Income Tax Income

0 Komentar